AMHERST TIMES

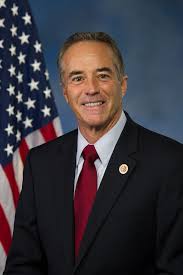

WASHINGTON, D.C. — For years Chris Collins, a congressman from New York, seemed to work all the angles for an obscure biotech company in faraway Australia.

WASHINGTON, D.C. — For years Chris Collins, a congressman from New York, seemed to work all the angles for an obscure biotech company in faraway Australia.

He invested millions. He plugged the company as he sat on its board and smoothed the way for its most promising drug.

When asked if he discussed the company, Innate Immunotherapeutics Ltd., with members of Congress and staff, Collins responded , “The bigger question would be, who haven’t I talked to?”

With news on Wednesday that Collins was charged with insider trading after he allegedly tipped off others to nonpublic information about Innate, prosecutors have zeroed in on stock trading on Capitol Hill, a practice fraught with potential conflicts. His indictment suggests that recent efforts to head off suspicious activities in Washington have fallen short, and it comes amid a flurry of examinations into politicians and government officials who enrich themselves and their associates, often well within the law’s outlines.

Collins, 68, is accused of sharing non-public information about a failed drug trial with his son, Cameron, who dumped his shares and alerted others, prosecutors said. Cameron Collins, 25, was also charged, as was his girlfriend’s father, Stephen Zarsky, 66.

Collins turned himself in to authorities Wednesday morning. He later appeared in Manhattan federal court where he and the two others pleaded not guilty. Lawyers representing the congressman and his son said they intended to mount vigorous defenses. An attorney for Zarsky declined to comment. Collins was released on a promise to provide a $500,000 bond.

He later said on Twitter that the charges are meritless and he plans to fight to clear his name while seeking re-election.

Originally published on Amherst Times. Republished with permission.